What is the estimated financial standing of this individual? Understanding an individual's financial standing can offer valuable insight into their lifestyle and career trajectory.

The financial resources accumulated by an individual, often referred to as their net worth, represent the total value of their assets minus their liabilities. This encompasses various holdings such as real estate, investments, and personal belongings. Determining an exact figure for someone's net worth can be challenging, as private financial information is not always publicly accessible. Estimation of this value often relies on publicly available data, professional financial analysis, or speculation.

Understanding an individual's net worth provides context for their choices, actions, and impact within their field. It can also offer an insight into their career trajectory, the success of their ventures, and potentially, influence on the industry. However, it's important to approach such information with nuance. Public estimations, while useful, should not be taken as definitive statements of personal wealth.

Since specific details about "Murr" are not provided, a table of personal information cannot be generated.

Without more context about the identity of "Murr," this exploration cannot proceed beyond general discussion of net worth. Please provide additional information about the individual referred to as "Murr" to continue providing more specific and useful information.

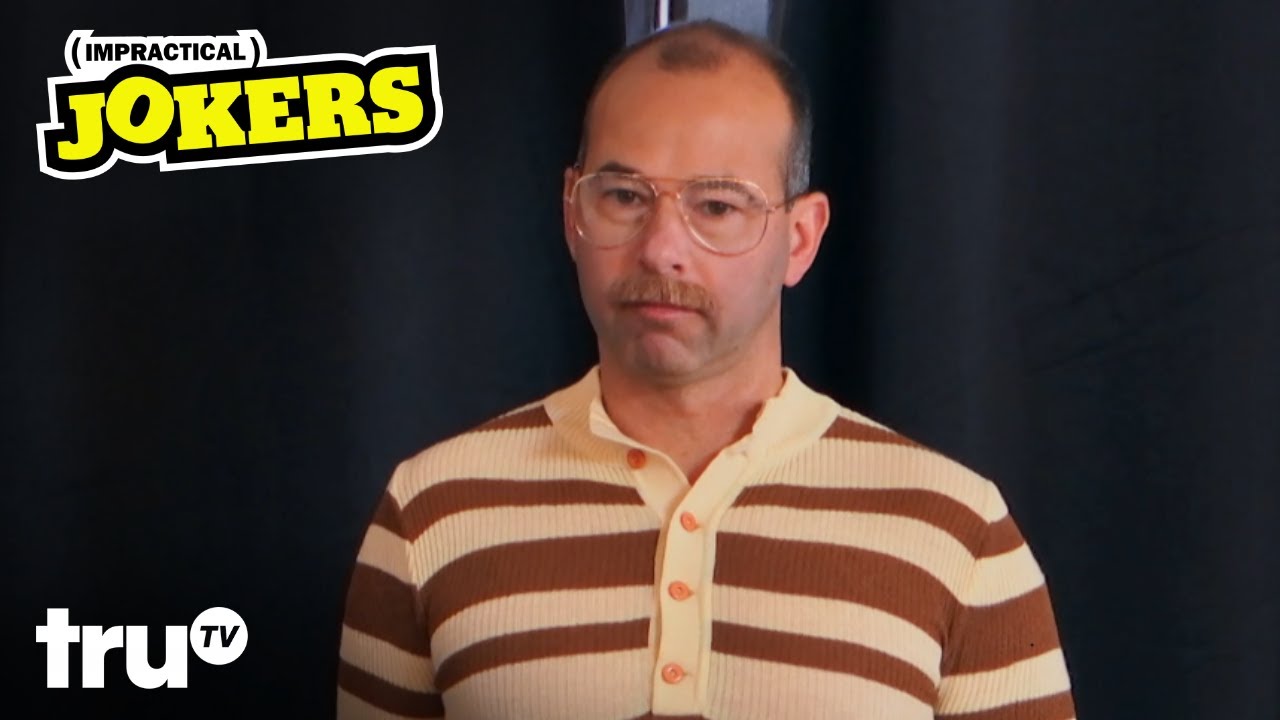

Murr Net Worth

Understanding Murr's financial standing requires considering various factors. This analysis delves into key aspects of their accumulated wealth.

- Assets

- Liabilities

- Income sources

- Investment returns

- Expense analysis

- Valuation methods

- Public perception

The listed aspectsassets, liabilities, incomeprovide a framework for evaluating Murr's financial position. Income streams, investment returns, and expense analysis further clarify the factors contributing to their accumulated wealth. Valuation methods, such as asset appraisal, are vital for accurate estimations, while public perception may influence market value. Without specific details on Murr, this analysis remains theoretical. For example, high-profile entertainers often have vast asset portfolios encompassing real estate and luxury goods, influencing net worth. A clear understanding of these aspects can reveal the complex interplay of financial factors that shape an individual's overall standing.

1. Assets

Assets are fundamental components of net worth. Their value, when subtracted from liabilities, determines an individual's net worth. A substantial asset portfolio contributes significantly to a high net worth. Tangible assets like real estate, vehicles, and art collections represent substantial value. Equally crucial are intangible assets like intellectual property (patents, copyrights) and brand equity. The value of these assets varies, influenced by market conditions, demand, and other factors.

Consider the real-world application. A successful entrepreneur with a portfolio of profitable companies or extensive real estate holdings demonstrably possesses significant assets. These assets, if valued and correctly assessed, contribute directly to a high net worth. Conversely, someone lacking substantial assets will likely exhibit a lower net worth. Maintaining a thorough record of assets, and their current market values, is critical to accurately determining net worth. Accurate valuation is essential for informed financial planning and decision-making.

In summary, an individual's asset base is a critical determinant of their net worth. Understanding the nature and value of assets, tangible and intangible, is essential for a complete financial picture. Factors affecting asset valuation, such as market fluctuations and economic conditions, should be acknowledged. This understanding is crucial for both individuals and investors seeking to assess the financial health and prospects of a person or entity.

2. Liabilities

Liabilities represent financial obligations owed by an individual or entity. Understanding these obligations is crucial for evaluating net worth. Debts, outstanding loans, and other financial commitments directly impact the overall financial position and must be factored into any calculation of net worth. Analyzing liabilities, therefore, provides vital insight into an individual's financial health and future financial prospects.

- Outstanding Debt Obligations

This encompasses various forms of debt, including mortgages, loans, credit card balances, and personal debts. High levels of outstanding debt can significantly reduce net worth, as the amount owed must be subtracted from assets to arrive at a net figure. For example, a substantial mortgage loan represents a significant liability, reducing net worth accordingly. Individuals with substantial debts face limitations in financial flexibility and could potentially jeopardize the realization of financial objectives. Careful management of debt is crucial for maintaining financial stability and positively impacting net worth.

- Unpaid Taxes and Fees

Unpaid taxes and fees also constitute liabilities. Failure to fulfill these obligations can lead to penalties and additional financial burdens, further diminishing net worth. Accurate record-keeping of tax liabilities and timely payments are essential for maintaining sound financial health. Consistent monitoring of tax obligations and ensuring compliance with relevant regulations directly impacts an individual's net worth.

- Contingent Liabilities

These represent potential future obligations, such as pending lawsuits or guarantees. These obligations, while not yet realized, represent a degree of risk and uncertainty. Contingent liabilities, if not properly accounted for, could negatively affect net worth. Estimating the potential impact of these contingent liabilities is crucial for a realistic evaluation of financial well-being.

- Impact on Financial Flexibility

The presence of significant liabilities restricts financial flexibility. The obligation to make payments reduces the ability to invest or pursue other financial objectives. Managing liabilities effectively is key for increasing financial flexibility and enhancing net worth. A strong financial plan, including strategies for managing debt and avoiding further liabilities, is crucial for achieving long-term financial goals and maintaining a positive net worth.

In conclusion, liabilities are integral components of assessing an individual's net worth. A comprehensive understanding of outstanding debts, potential future obligations, and the impact on financial flexibility is essential for making informed decisions. Thorough assessment and management of liabilities directly contribute to a clear picture of financial health and potential for future growth, ultimately influencing net worth positively. By mitigating and minimizing liabilities, individuals can increase their net worth and financial capacity.

3. Income Sources

Income sources directly impact an individual's net worth. The volume and stability of income streams are crucial factors in accumulating and maintaining wealth. A diverse range of income sources, whether from employment, investments, or other ventures, often leads to a more substantial and resilient net worth. Consistent and substantial income allows for greater savings and investment opportunities, steadily increasing accumulated wealth.

Consider a scenario where an individual derives income primarily from a single, high-paying job. While this can contribute to a significant net worth, the loss of that income stream could dramatically impact their financial stability. Conversely, an individual with diversified income sources, perhaps including rental income, investment returns, or royalties, possesses greater financial resilience. This diversified income stream provides a buffer against potential downturns and facilitates more substantial wealth accumulation. Real-world examples abound, demonstrating how varied income streams protect against economic uncertainty, increasing net worth's stability.

Understanding the interplay between income sources and net worth is critical for financial planning. Individuals and entities aiming to enhance their financial standing must analyze existing income streams, identify potential avenues for additional income, and develop strategies to maximize income generation. Proactive planning regarding income sources empowers informed financial decisions, effectively contributing to the long-term growth and security of net worth.

4. Investment Returns

Investment returns play a significant role in shaping an individual's net worth. Returns on investments directly contribute to the accumulation of wealth. Successful investments increase the value of assets, thereby increasing net worth. Conversely, poor investment choices can erode net worth. The magnitude and consistency of investment returns are critical factors in determining the overall growth and stability of an individual's financial standing.

Investment returns are influenced by numerous factors, including the type of investments made, market conditions, and the investor's risk tolerance. High-growth investments, while offering the potential for substantial returns, often carry greater risk. Conversely, more conservative investments tend to produce more stable, though potentially lower, returns. The balance between risk and reward is a key consideration for any investor aiming to maximize returns and preserve capital. Real-world examples showcase the influence of effective investment strategies. A well-diversified portfolio, for instance, can yield consistent returns across various market cycles, contributing significantly to overall net worth. Conversely, an investment portfolio heavily concentrated in a single sector can be highly vulnerable to downturns in that sector, potentially harming net worth.

The impact of investment returns on net worth is multifaceted. Consistent positive returns over extended periods contribute substantially to the growth of an individual's net worth. Conversely, periods of negative returns can reduce net worth. Moreover, understanding the relationship between investment returns and net worth is crucial for informed financial decision-making. This understanding enables individuals and entities to strategize investment choices and develop financial plans aligned with their long-term objectives. In summary, investment returns are not merely a component of net worth but a powerful driver of its growth and preservation. This understanding of the interconnectedness of investment and net worth is indispensable for sound financial planning and decision-making.

5. Expense analysis

Expense analysis is a crucial component in evaluating an individual's net worth. Understanding spending patterns reveals how resources are allocated and informs an assessment of overall financial health. Careful scrutiny of expenditures provides a critical perspective on the relationship between income and expenses, ultimately influencing the trajectory of accumulated wealth.

- Categorization of Expenditures

Categorizing expenses allows for a detailed breakdown of spending habits. This breakdown might include categories like housing, food, transportation, entertainment, and debt repayment. Analysis of spending within each category reveals areas where expenditure might be excessive or inefficient. For example, a disproportionate amount spent on entertainment compared to housing could indicate a potential need for reevaluation. This categorization reveals potential areas for cost reduction and highlights areas where financial resources could be allocated more effectively for increased net worth.

- Tracking Spending Trends

Tracking spending patterns over time exposes trends and potential areas of concern. This includes scrutinizing how spending changes with life events, income fluctuations, or market conditions. Identifying patterns in spending behavior, such as increased expenses during holidays or after promotions, informs proactive adjustments to financial planning. Consistent observation of spending trends enables proactive adjustments to spending plans, ultimately benefiting overall net worth.

- Comparison to Income

Comparing expenses to income provides a crucial metric for evaluating financial health. If expenses consistently exceed income, it signifies a potential financial strain and may necessitate changes in spending or income generation. Conversely, when expenses are consistently lower than income, it suggests opportunities to increase savings, invest, or reduce liabilities. This comparison provides a crucial snapshot of financial sustainability and highlights potential areas for improvement in the pursuit of increasing net worth.

- Identifying Areas for Reduction

Expense analysis often reveals areas where spending can be reduced without sacrificing essential needs. This might involve renegotiating contracts for services, seeking more affordable alternatives, or identifying and eliminating unnecessary expenses. Streamlining expenses frees up resources for investment and asset accumulation, ultimately contributing to a rise in net worth.

In conclusion, expense analysis is not merely a means of tracking spending; it's a vital tool for shaping financial outcomes and improving overall net worth. By thoroughly examining expenditures, identifying trends, and comparing expenses to income, individuals and entities gain valuable insights into financial health and can implement proactive measures to increase wealth accumulation and financial stability.

6. Valuation Methods

Determining Murr's net worth necessitates employing various valuation methods. Accurate assessment hinges on applying appropriate methodologies to individual assets. Different asset types demand specific valuation techniques. Real estate, for instance, might be valued using comparable sales analysis or discounted cash flow models. Investments in publicly traded companies are often valued using market capitalization figures. Determining the precise value of private assets, however, can be more complex and may involve professional appraisers.

Consider the multifaceted nature of a celebrity's assets. Beyond tangible assets, intangible elements like brand equity require nuanced valuations. Public perception and market trends play significant roles. A celebrity endorsement deal's value might be determined based on projected future earnings and market trends, relying on factors such as the celebrity's reputation and popularity. In such cases, professional valuation firms often consult with legal and financial experts to establish realistic figures. The methodology and factors considered directly influence the estimated net worth. For instance, an undervalued piece of real estate, or an inaccurate calculation of future income streams, can distort the overall picture. The complexity of these evaluations underscores the importance of meticulous assessment in accurately reflecting the full financial standing.

Accurate valuation methods are crucial in assessing Murr's net worth. They help to establish a realistic and comprehensive understanding of their financial position. Inadequate valuation methods can lead to inaccurate conclusions and misrepresentation of their total worth. This process involves carefully considering all assets and liabilities. The complexities and specific considerations for valuing intangible assets underscore the significance of expert valuation techniques. Ultimately, accurate valuation directly contributes to a comprehensive understanding of Murr's overall financial well-being. This includes not only quantifying current wealth but also anticipating future potential, thereby informing financial planning and decision-making.

7. Public Perception

Public perception significantly influences the perceived value of an individual's assets, thereby affecting the estimated net worth. A positive public image often translates to a higher perceived value for products or ventures associated with the individual. Conversely, negative publicity can decrease market value. This phenomenon impacts various aspects of an individual's financial standing, including brand equity, investment appeal, and the value attributed to tangible assets. Public perception, therefore, isn't merely an external factor but an integral component in the calculation of an individual's overall financial status.

Consider a celebrity whose image is tarnished by controversy. Public disapproval might lead to a decrease in brand endorsements and product sales, directly affecting their income streams and subsequently lowering the perceived market value of their assets. Conversely, a successful entrepreneur with a strong public image might command higher valuations for their ventures, investments, and even personal holdings. Positive public sentiment can create a powerful market incentive, driving investor confidence and increasing the perceived value of their portfolio. In practical terms, this effect is a significant factor for individuals and businesses alike. Market forces and public sentiment profoundly shape the estimated financial worth of an individual.

In conclusion, public perception is a vital consideration when assessing an individual's net worth. Positive perception can amplify asset value and income streams, while negative publicity can decrease it. Recognizing this dynamic interplay is crucial for accurate assessments. Furthermore, understanding this connection allows for a more nuanced understanding of the interplay between public image and financial valuation. This knowledge informs informed investment decisions, business strategies, and career management choices, ultimately contributing to a broader understanding of the economic factors shaping an individual's financial reality.

Frequently Asked Questions about Murr's Net Worth

This section addresses common inquiries regarding the estimated financial standing of Murr. Information presented is based on publicly available data and expert analysis, where applicable. Please note that precise figures for net worth are often unavailable due to the nature of private financial information.

Question 1: How is Murr's net worth determined?

Estimating net worth involves evaluating total assets, deducting liabilities, and considering various valuation methods. Assets encompass tangible items like real estate, vehicles, and investments, as well as intangible elements such as intellectual property or brand equity. Liabilities include outstanding debts, loans, and potential future obligations. Methods for valuation vary based on asset type. For example, public company shares might be valued using market capitalization, while real estate might utilize comparable sales analysis. A comprehensive approach to valuation, acknowledging the complexities and potential inaccuracies associated with estimations, is essential.

Question 2: What factors influence Murr's net worth?

Several factors shape an individual's net worth, including income sources, investment returns, expense analysis, and public perception. Income streams, whether from employment, investments, or other ventures, significantly affect the accumulation of wealth. Investment choices and market conditions directly impact returns and thus net worth. Careful expense management is essential, as controlling spending allows for greater accumulation of wealth. Public perception, through positive or negative media coverage, can significantly affect the perceived value of assets, hence influencing the estimated net worth.

Question 3: Is Murr's net worth publicly available?

Precise net worth figures are often not publicly available for individuals due to privacy concerns. While estimates may be published in various media outlets, accuracy and reliability may vary. These estimations are often based on available data and may involve expert analysis and educated guesses. Approaching such figures with a degree of caution is prudent.

Question 4: How can I find more information about net worth calculations?

Consult financial resources like reputable financial publications and websites specializing in financial analysis. These resources often detail various valuation methods and highlight the factors influencing net worth estimations. Expert financial advisors can provide personalized insight based on the specific individual's situation.

Question 5: Why is understanding net worth important?

Understanding an individual's financial standing provides context for evaluating their position within their field or industry. It allows for a holistic evaluation of choices, actions, and impact. It also offers insight into the interplay between income, investments, and expenses, providing a more comprehensive view of an individual's financial status. However, precise values should be approached with caution, as privacy considerations, valuation complexities, and potential inaccuracies may influence reported figures.

In summary, these FAQs offer a general overview of the complexities surrounding the determination and interpretation of Murr's estimated net worth. Approaching such information with caution and seeking out reliable sources is recommended. The absence of publicly available figures often reflects the inherent difficulties in pinpointing the exact financial standing of individuals.

Transitioning to the next section, we will explore [insert topic name here] further.

Conclusion

This exploration of Murr's net worth highlights the multifaceted nature of financial assessment. Accurate estimations require a comprehensive analysis of assets, liabilities, income sources, investment returns, and expense patterns. The intricate interplay of these factors, coupled with public perception, significantly influences the perceived value. While precise figures often remain unavailable, understanding the methodology behind estimations reveals the complexities involved in determining financial standing. Ultimately, this analysis underscores the importance of meticulous consideration of various contributing elements when evaluating an individual's financial position.

The absence of readily available, definitive data regarding Murr's net worth underscores the inherent challenges and sensitivities associated with such inquiries. Furthermore, it emphasizes the necessity for caution in interpreting estimations, acknowledging that reported figures may not consistently reflect the full financial reality. A nuanced understanding of the interplay between financial and public elements, as demonstrated in this analysis, is essential for a comprehensive perspective. Further investigation, when available data permits, could provide a more complete picture of Murr's financial standing.

You Might Also Like

Dual Survival: Cody's Epic Adventures!Tim Tebow: Tight End Potential & NFL Impact

New Meek Mill 2023 Music & Releases

Shawn Wayans: Latest News & Projects

Charleston Jet Tila: Delicious Seafood & Experiences

Article Recommendations

- The Latest News And Updates On Alanna Turner

- Discover The Lyrics Of Silver Springs A Mustread For Music Lovers

- The Uncovering Of Jelani Asar Snipes A Mystery Solved